Simon Richardson

Simon Richardson

Last update 14. April 2023

What is a car subscription?

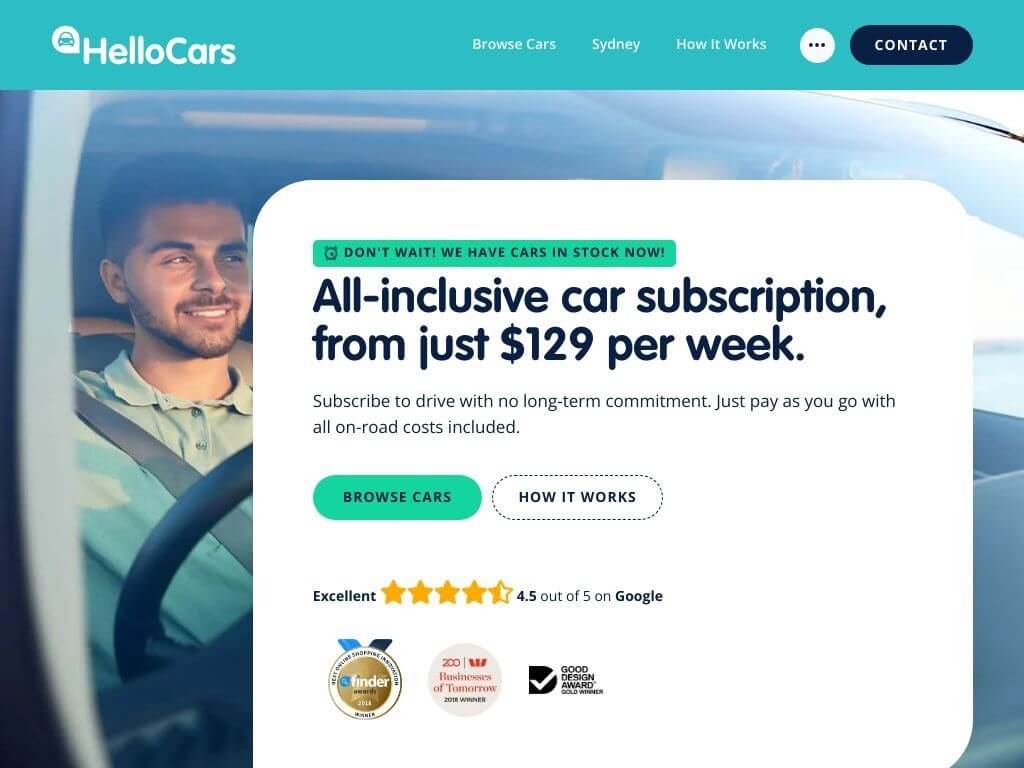

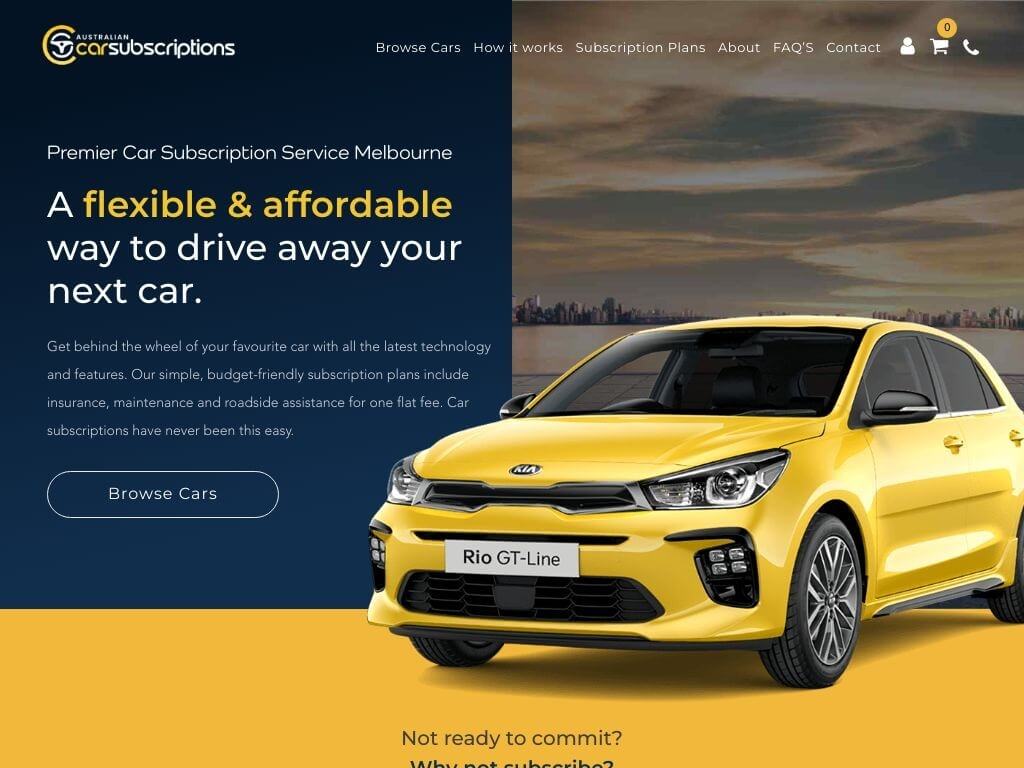

- Car subscriptions are similar to long-term rentals, with terms ranging from 1 to 24 months on a fixed monthly rate.

- Breakdown cover, tax, maintenance and often insurance are all included in the price. You only pay for gas and any tolls/penalties.

- Most booking processes are online or app based. The terms are generally quite flexible with penalty-free cancellations and even the chance to regularly flip vehicles.

7 tips that you should remember when subscribing to a car

We have tried out a few different subscriptions, so we know what to expect when you’re going through the process. The following tips will help you understand what to do, as well as how to avoid the types of mistakes and pitfalls that can be irritating and expensive.

Tip # 1: Check the Conditions

If you want to get started with a car subscription, you should pay attention to the contract conditions.

- Firstly, your provider should be clear about notice periods, add-on and joining fees, and any other terms. If they’re burying it in the small print, that’s a red flag. See our car subscription providers comparison table for details.

- Secondly, choose a company that provides convenience for your situation. Check delivery terms and rates, what’s included on the app in terms of concierge services, and typical lead times.

Tip # 2: Pay attention during the vehicle handover

Allow plenty of time at the vehicle handover. Make sure you document the condition of the car on paper. Also, take photos and a video with your cell phone camera.

Why? Because handovers tend to be quite quick. The driver responsible for the delivery is usually adhering to a tight deadline and wants to get their job done quickly.

You’ll notice it’s quite the opposite when it comes to return the vehicle. You get a professional appraiser, and they are extremely thorough and detailed. If you haven’t done your own thorough inspection to start with, this might result in extra costs.

When you get the car, it’s more or less unchecked and the delivery appraisal won’t be particularly detailed

This can result in the returns appraiser finding things that they didn’t spot on delivery, which weren’t actually caused by you. So, take your time during the handover. Even if the driver wants to leave immediately, stay calm. Take your pictures, check all the documentation, and don’t let them go until you’re happy.

Extra tip for vehicle handover: If you’re using a company for the first time, you could even use an online appraisal tool. There are several available free online and some companies will even offer an attended appraisal on request.

Tip # 3: what do car subscriptions cost? Understand the costs!

The most important cost with car subscriptions is the monthly rate. This varies depending on the model, specification, included mileage plan and subscription length.

You can find vehicles for as little as $115 a week, but luxury vehicles can go up to almost $500 per week.

In addition to the subscription rate, there are other charges that can affect how much you pay overall:

- Setup fee / security deposit

- Rego

- Delivery costs

- Return delivery costs

- Additional costs for subscription features such as additional drivers or mileage allowance

- Fuel costs (or electricity)

- Cleaning and Detailing (often included)

- Costs for parking and permits

- Insurance excess

Recommendation: Estimate your total monthly costs by adding these together. Expect that not everything will be included, read the Ts and Cs carefully, and get your head round the true cost of the subscription.

Top tip: The deductibles are usually the biggest “hidden” cost.

That leads us straight to tip 4.

Tip # 4: Your insurance excess

Be really aware of the insurance terms and the fixed excess, particularly with shorter-term leases. These costs can be very high. Of course, you won’t necessarily pay the entire deductible if you do some minor damage to your vehicle – you’ll pay the cost of the damage instead. But if you have an accident that writes off the vehicle, you’ll be stuck with that excess no matter what.

So, it pays (quite literally) to make sure you know exactly what the costs are, and the Ts and Cs.

Extra tip for your deductibles: You can expect the deductible charge to be between $1500 and $3000. If you find you’re being quoted above $2500, consider looking elsewhere or requesting that you choose your own insurance. You will also find that there is often the chance to pay extra up front for a reduced excess.

You pay your car subscription by bank transfer or credit card.

Conclusion: The main impact on your overall cost is largely impacted by the excess and the number of claims you need to make, especially with short-term subscriptions.

Tip # 5: The stated delivery window is not binding

According to the terms and conditions of most providers, the specified delivery times for your vehicle are non-binding. Some subscribers have reported that agreed delivery times have not been adhered to.

Bear this in mind and allow extra time for lateness. In particular, you might want to consider avoiding making bookings that are time-sensitive for that day, like flights or important appointments. Of course, this doesn’t apply if your provider is offering collections only.

Conclusion: Leave plenty of time on delivery day – but don’t worry; the vast majority of deliveries go smoothly.

Tip # 6: New or used cars?

So, you want a brand-new car? Depending on the company, this often possible, but the majority of subscription cars are used cars with low mileage. There could be a few scratches on the paintwork, but most cars are less than 2 years old. The exception to this is if you go with a subscription service offered by a rental company, like Hertz or Enterprise.

Tip # 7: Pay attention to the included mileage

Sometimes, you will find car subscriptions with extremely low monthly rates. But the catch is often that the number of included miles is very low, and you have to pay quite an expensive per-mile price for exceeding that limit.

Bearing in mind the cost of gas, find an offer that combines a decent price with a good monthly mileage. Typically, you should be able to find contracts that offer 2000kms per month.

Do choose carefully if you are thinking of exceeding your limit. The excess cost per mile varies quite heavily and it’s always worth asking if the provider will offer you an add-on package instead.

If you pay attention to these seven tips, you’ll have a much better time of it when you go for it and dive into a subscription. Remember to check our comparison table to help.

Basic requirements for car subscriptions

Most car subscription companies typically have the following conditions:

-

- Minimum age 21 years, maximum age 75-85 (depending on vendor)

- Credit check – no history of bankruptcy within last 7 years

- Must hold a minimum P2 driving license with no accidents or speeding fines in the last 12-60 months (vendor dependent)

- Australian resident

- If you fulfil all these conditions, the vast majority of companies will have something for you.

Benefit of using our service:

A comprehensive list of providers & conditions here:

Car subscription providers in Australia

- There are three types of companies that offer car subscriptions:

- Dealerships,

- Car rental companies, and

- Specialist subscription providers.

Here is the list of the current car subscription providers in Australia:

Testing an electric vehicle with a subscription – is it a good idea?

Would you like to try out an electric vehicle for a few months with no obligation? A car subscription is ideal for this, because you will find that many providers now offer electric cars.

The number of electric options is increasing with demand. The current percentage of hybrid models and electric cars on the market is around twelve percent, but it’s going up each year. What’s more, lots of motorists are already using subscription companies as a way into the electric market.

The advantages are numerous. With a subscription, you can:

- Get familiar with charging at home and on the road

- Try out a few vehicles

- Get hold of an electric car quickly, as lead times for purchases are often quite long

- Figure out what you might save on fuel by switching to electric

A comparison of car subscriptions, long-term rentals & leasing

We have looked at the similarities and differences between these three different forms of car “ownership” in the table below. Of course, these are general comparisons – not every company offers the exact same terms. You can find a few notes regarding these different features below the table.

| Subscriptions | Leasing | Purchase on finance | |

|---|---|---|---|

| Typical contract lengths | 1-12 months | 12-48 months | 24-60 months |

| Price / month | Quite cheap | Varies | Quite high |

| Flexibility (cancellations, rolling usage) | High | Low | Low |

| Online booking process | Yes | Sometimes | Yes |

| Exact car you want | Depends on the provider | Yes | Yes |

| Swapping vehicles | Depends on the provider | No | No |

| Inclusive of tax, breakdown cover, maintenance etc. | Yes | No | No |

| Insurance included? | Yes | No | Yes |

| Depreciation risk | No | Yes | Yes |

| Repair risk | No | Yes | Yes |

| Free mileage | Yes | Yes | No |

| New car | Depends on the offer | Depends on the offer | Yes |

The contract length

With a car subscription, you get many inclusive services and a car you can usually exchange on demand, with contract lengths of around one to twelve months.

With leases, there is more paperwork and longer lead times. Typically, the contract lengths are longer, going up to four years.

If you’re buying a new car, the lead times can be quite long if you’re ordering it in – or you can walk away the same day with a new or second-hand car from a forecourt. For finance arrangements, contract lengths are flexible with an average of 2-5 years depending on your finances.

Of course, with all three types, there are differences between the various providers in terms of contract length.

Price

If you look across the three methods, you’ll notice that subscriptions are cheaper than leasing and instalment plans. Whether or not it’s worth going for the higher priced option depends on your personal needs. Leasing is often good for companies that have a fleet and need flexibility, while subscriptions typically make more sense for individuals.

With outright and finance purchases, it’s a bit different with a focus on a longer term and higher pricing to reflect the commitment.

Flexibility

With car subscriptions, you benefit from a high level of flexibility. Contracts vary in length and cancellations and extensions are easy to implement. With many providers, you can also swap cars at short notice.

Leasing, in contrast, offers very little flexibility because you sign up to a specific contract for a specific vehicle. You can’t reduce the contract length without a heft penalty, and you can’t change vehicles during the contract.

Similarly, with a purchase, you commit to buying a specific vehicle, so after your initial cooling off period, there is zero flexibility.

Online booking

Most subscription services are online or app based. They involve minimal paperwork, and you don’t have to go anywhere to complete a booking.

You can arrange leases online, but you need to be computer savvy as there is a lot of paperwork to do. For this reason, customers often prefer to attend offices in person.

The standard in the past for purchases was to visit a dealership, but companies like carconnect are changing that and it is increasingly common for car owners to buy online.

Exact car you want

Some providers will let you configure the spec of your vehicle in the subscription market. Of course, this will alter the ongoing cost. The great advantage of leasing is that it is highly customizable as you are committing to having it for a long time. Of course, with purchasing, you always pick the exact vehicle.

Inclusive Services

As far as inclusive services are concerned, subscriptions have a lot included. You’ll get rego, certification, maintenance, breakdown cover and insurance (although the latter is not always the case with subscriptions). You only pay for fuel or electricity. Of course, you bear no depreciation risk either.

This is slightly different with leasing. Here, you bear all the costs and responsibilities, such as registration, breakdown, detailing and maintenance, etc. You ‘re also responsible for insurance on top of the monthly lease cost. And if you damage the car and cause it to depreciate, that is also a cost you will bear at the end of the contract – it usually comes off your deposit.

With ownership, the only add-ons you can purchase relate to the length and detail of warranty.

New cars

Whether you get a new car or not depends on the provider with all three methods of car “ownership” – or your preference and finances in the case of purchasing. However, it is possible across the methods and becoming a more popular option over time, especially with electric vehicles.

Even more about car subscriptions!

The concept of car subscriptions is still relatively new , so questions keep coming up that we answer in our FAQs.

A comprehensive list of providers & conditions here:

Australia - English

Australia - English Brasil - Portuguese

Brasil - Portuguese Canada - English

Canada - English Deutschland - Deutsch

Deutschland - Deutsch España - Español

España - Español France - Français

France - Français India - English

India - English Italia - Italiano

Italia - Italiano Nederland - Nederlands

Nederland - Nederlands Norsk - Bokmål

Norsk - Bokmål Sweden - Svenska

Sweden - Svenska UK - English

UK - English US - English

US - English Österreich - Deutsch

Österreich - Deutsch